Family violence has been on the government agenda for several years now, but one issue that is seldom raised is the role of financial insecurity as a driver of violence. In today’s analysis, Phoebe Nagorca-Smith of Good Shepherd Australia New Zealand (@GoodAdvocacy) explains how the gendered experience of the welfare system increases women’s risk of violence.

Read MoreExamining, and supporting, women’s financial wellbeing at a single point in time will never fully capture, nor compensate for, the effects that experiences of violence have on their lives. Life Course Centre (@lifecourseAust) researchers Dr Alice Campbell (@ColtonCambo), Professor Janeen Baxter (@JaneenBaxter7) and Dr Ella Kuskoff (@EllaKuskoff) from The University of Queensland (@UQ_News) are investigating how violence and multidimensional disadvantage intersects and accumulates for women over the life course.

Read MoreAnti-Poverty Week is an event held every October to raise awareness and understanding of the causes and consequences of poverty in Australia, and to encourage action to end it. In today’s analysis, researchers at the Life Course Centre (@lifecourseAust) are highlighting the links between women, violence and poverty, and the structural inequalities that must be addressed to stop it. A summary of this analysis is presented here by Dr Alice Campbell (@ColtonCambo) and Professor Janeen Baxter (@JaneenBaxter7); you can read their full report here.

Anti-Poverty Week runs from 17-23 October this year.

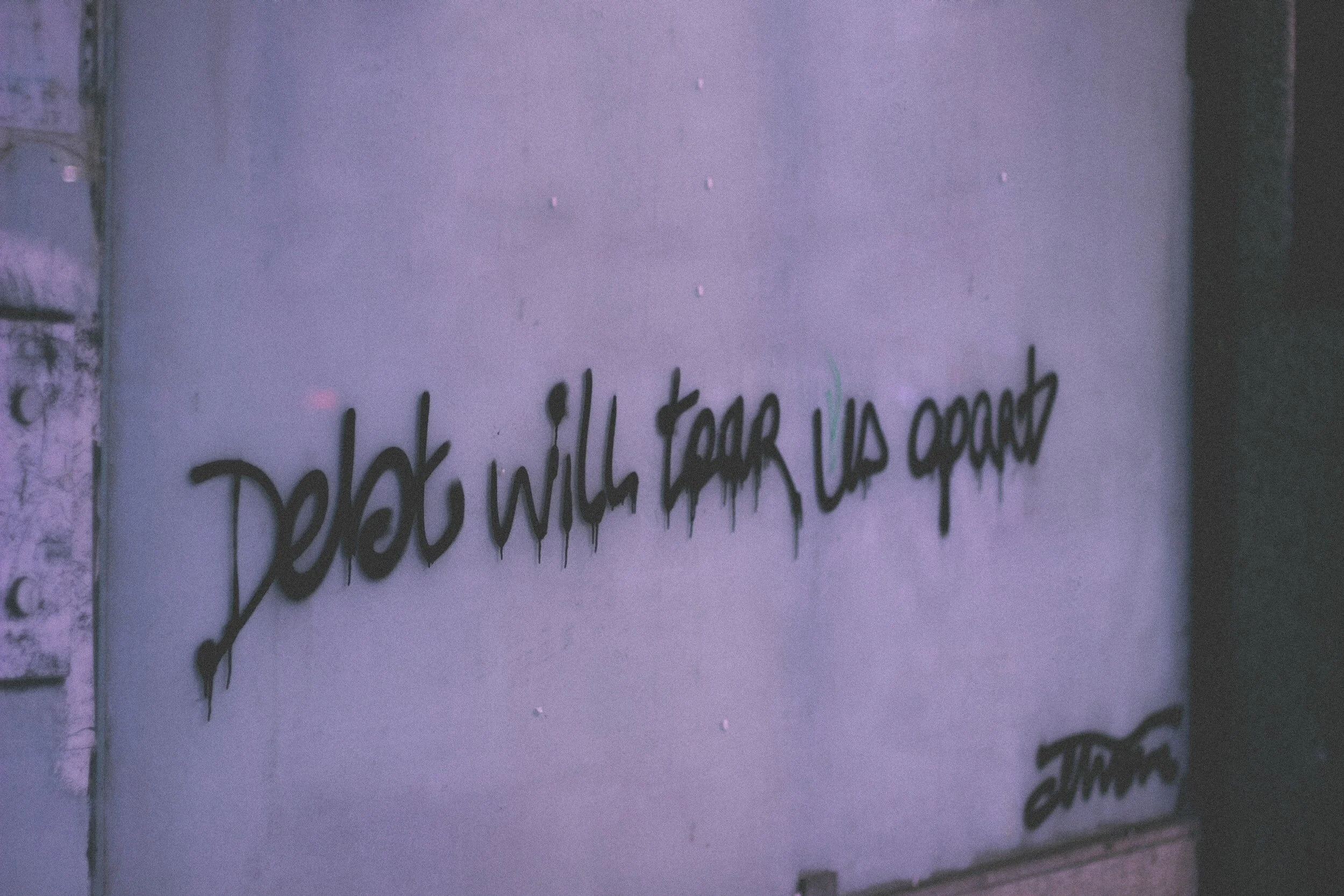

Read MoreAs pandemic impacts continue to be felt across much of Australia, changes in personal debt, particularly for women and lower-income households, is increasingly concerning. In today’s analysis, Dr Lucinda O’Brien (Melbourne Law School), Dr Vivien Chen (Monash Business School), Professor Ian Ramsay (Melbourne Law School) and Associate Professor Paul Ali (Melbourne Law School) report on research recently published on how under -regulated debt collection practices are contributing to women’s lack of safety.

Read MoreThe Women’s Safety Summit was noticeably silent on the social safety net. As an area over which the Federal Government has complete control, it represents an accessible lever for policy change. In today’s analysis, the paper that was tabled jointly by the National Council for Single Mothers and their Children (NCSMC) and ACOSS (@ACOSS) is presented, detailing eleven ways that social security works to harm women. Terese Edwards (@Terese_NCSMC) of NCSMC provides a preface.

Read MoreThe Federal government has proposed changes to the National Consumer Credit Protection Act which will, it says, make credit more accessible to individuals and small businesses during the recovery period from COVID-19. However, these changes have been critiqued as a way to circumvent some of the recommendations from the Banking Royal Commission. In today’s analysis, Lily Gardener and Madeleine Ulbrick (@MaddyUlbrick), both of Good Shepherd Australia New Zealand (@GoodAdvocacy) summarise their submission commenting on the Amendment, detailing how such changes are likely to further disadvantage women who are still struggling from the pink recession.

Read MoreThe important message for the community in these challenging times is that people seeking to repair their credit reports or negotiate with their creditors do not need to pay expensive fees.

Read MoreLow-income single mothers continue to be caught in the binds of poverty and insecurity, with limited choices and opportunities. Despite some policy changes, including a temporary increase in social security payments and suspension of mutual obligation requirements, the underlying infrastructure of inequality remains. In today’s analysis, Dina Bowman (@Dina_Bowman) and Seuwandi Wickramasinghe, both of the Brotherhood of St Laurence (@BrotherhoodInfo), share a summary of their recently-published report Trampolines not traps: Enabling economic security for single mothers and their children.

Read MoreA new report from the Centre for Social Impact provides an overview of the impact of the pandemic on the financial wellbeing of Australians, and explains the key elements of the government response so far.

Read MoreIf you have ever needed money in a hurry it may have been tempting to apply for a small loan to tide you over until your next pay packet. During Covid-19 and with increasing financial precarity, ‘payday’ loans may be how people resource short-term solutions as many people look online for financial help. Research from Dr Vivien Chen at Monash Business School’s Department of Business Law and Taxation shows the rise of digital platforms has significantly increased consumer access to payday loans. The financial risk posed by Covid-19 presents a key opportunity for governments to develop policy and mechanisms to protect people in financial distress. This article originally appeared in Monash Impact.

Read MoreThere is increasing understanding that economic abuse coincides with other forms of family violence and abuse, as the perpetrator is driven to exert power and control. Despite this, its hidden nature and the various forms it takes means it is seldom addressed in system responses. In today’s post, Dr Madeleine Ulbrick (@MaddyUlbrick) of Good Shepherd Australia New Zealand (@GoodAdvocacy) shares insights from her recently completed PhD on economic abuse responses in Victoria. She argues that to effectively achieve women’s physical security, their material security must be prioritised.

Read MoreMillions of Australians are currently dependent on some form of government welfare payment, and many are experiencing financial stress for the first time. As the consistently poorest household type in Australia, single mothers are disproportionately acquainted with the distress of trying to maintain a household on low welfare payments and precious employment. Unsurprisingly, new ABS data indicates that single mothers have had the worst employment outcomes during COVID-19. In today’s analysis, Margaret Ambrose of the Council for Single Mothers and their Children reports on the findings of a national survey of single mothers to uncover what their pain points are, and how these might be addressed to increase their financial security and place them and their children on a positive trajectory.

Read MoreResearch by Evgenia Bourova, Professor Ian Ramsay and Professor Paul Ali at Melbourne Law School highlights the challenges that financial counsellors and other consumer advocates face in assisting women with debt problems resulting from economic abuse — an often ‘hidden’ form of family violence. The risk of this type of abuse escalating during and in the wake of the COVID-19 pandemic is high. This article was originally published on Broad Agenda.

Read MoreWith the recent announcement by the Coalition Government to expand the use of the Cashless Debit Card (CDC) to more people on income support, it is continuing to be positioned as a positive intervention, providing people who need it most with a ‘financial literacy tool.’ With approximately 2.3 million people receiving some form of income support, there is currently great interest in how the Card, as well as other forms of cashless welfare, are experienced by those who have been subjected to these policies. Today’s important piece by researchers Zoe Staines (@Zoettes), Greg Marston, Philip Mendes, Shelley Bielefeld and Michelle Peterie (@MichPeterie) draw on their ground-breaking independent report into experiences and impacts of cashless welfare to explain how women and children are adversely affected.

Read MoreWith the government’s recent announcement that they plan to start rolling out the Cashless Debit Card beyond its trial phase, thousands of people currently struggling to get by on low rates of the Newstart Allowance are poised to have their lives made even harder. The Accountable Income Management Network (@AIMNau) today outlines some of the key concerns why expanded the CDC is a bad idea - for low-income Australians and for the Big 4 banks, Coles and Woolworths.

Read MoreFor Anti-Poverty Week, we are focussing on older women’s disadvantage, accumulated across a lifetime. An earlier post explored how older women are now the largest demographic reliant on the Newstart Allowance, which is pushing many into crisis. In today’s post, “Lorraine”[1] generously shares her story, in her own words. Lorraine is 70 years old, currently living in private rental accommodation. She receives a full age pension and commonwealth rent assistance while also working part-time. Her story contains many of the barriers and bumps that all women face – relationship breakdown, single parenting, the need to reskill, relocation for jobs, being called upon to help with caring for ageing parents or grandbabies, and that ever-present sexually-transmitted debt. Lorraine was one of several peer researchers on Per Capita’s (@PerCapita) recent report on innovative solutions for housing precarity for older women. We are thankful to her for allowing us to share her story here.

Read MoreIn this BusinessThink re-post, Dr Ann Kayis-Kumar from the University of New South Wales Business School introduces us to the Nationwide Tax Clinic Program. These federally funded clinics are designed to meet the needs of Australia’s vulnerable taxpayers. Dr Kayis-Kumar explains why and how these clinics came about and concludes with the overarching purpose of the Tax Clinic program, to foster a more socially just tax system.

Read MoreIn today’s post Dr. Archana Voola, Research fellow at University of New South Wales, discusses the societal, community and individual levels factors playing a role in our everyday financial lives. The daily news media depicts stories about the debt crisis, housing un-affordability and sluggish wage growth. But what is actually happening behind these numbers? Who are the humans who make up the data? And what can we do about it? Archana uses her sociological imagination to uncover the icebergs in the financial seascape of Australia.

Read More