Christian Eva (@ChristianEva9), Kerry Bodle, Dennis Foley, Jessica Harris, and Boyd Hunter discuss their new research in the Australian Journal of Social Issues on Indigenous owned businesses - to help inform future policy direction for both Indigenous employment and Indigenous business policies.

Dr Adrian Bazbauers (@AdrianBazbauers) of the Public Service Research Group, UNSW Canberra discusses his new analysis of how multilateral development banks approach gender.

In today’s post, Emma O’Neill of Good Shepherd (@GoodShepANZ) explores the potential impacts of the Government’s proposed regulation of Buy Now, Pay Later Products. Emma is a Senior Policy & Advocacy Advisor with a particular interest in women’s economic security, gender and climate change, and the impacts of marketisation on social equity.

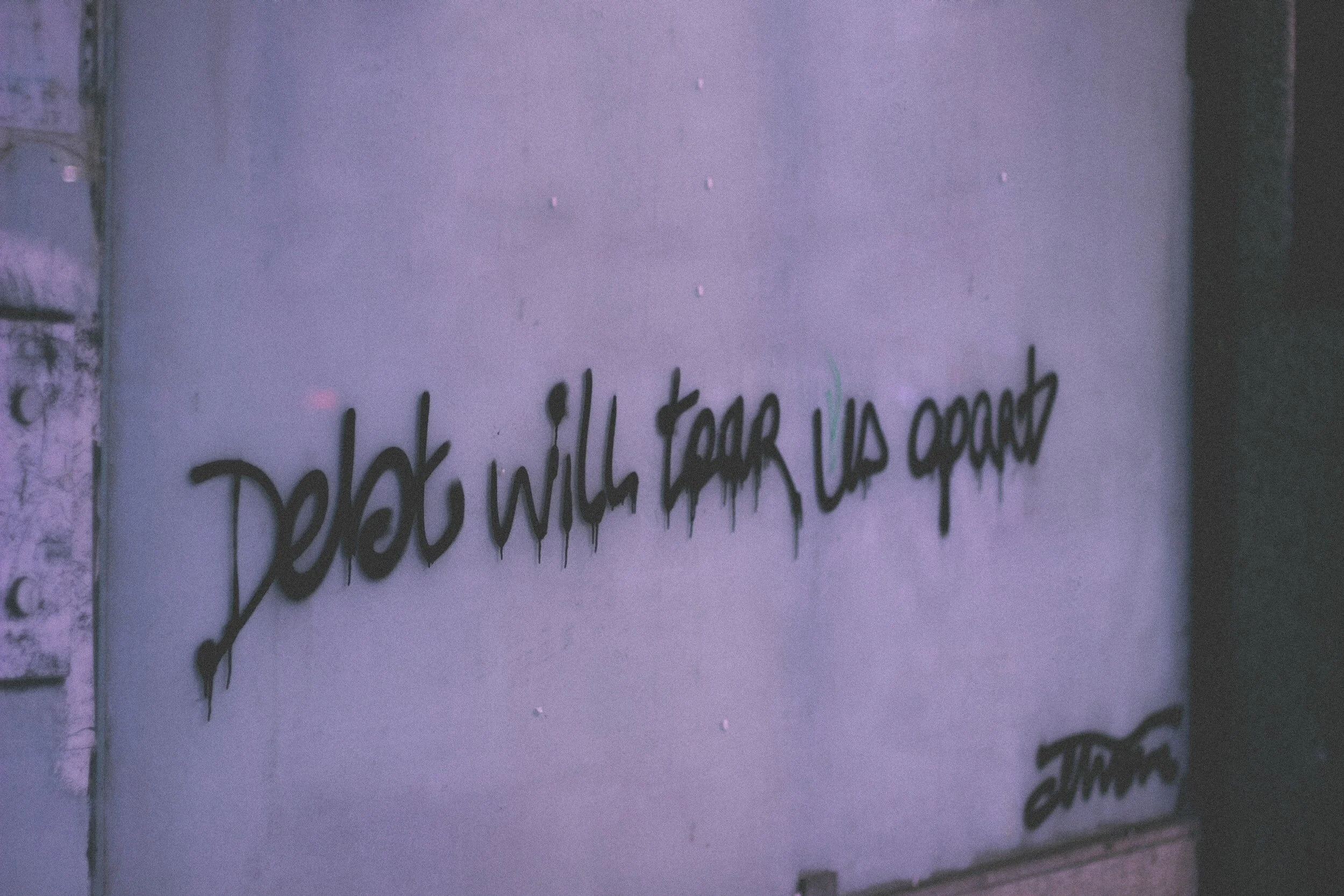

In today’s analysis, Phoebe Nagorcka-Smith (@PNagorckaSmith) of Good Shepherd Australia New Zealand (@GoodShepANZ) uses evidence from their recent ‘Safety net for sale’ report to explore how Buy Now Pay Later is used to trap family violence victim-survivors in debt, and why regulation is key to preventing it.

Dr Kim Moloney (@Global_Academic) of Hamad Bin Khalifa University shares a preview of her new book Who Matters at the World Bank: Bureaucrats, Policy Change, and Public Sector Governance, which tells the story of civil servant influence and the rise of public sector reform at the World Bank (read a sample chapter here).

Our care industries are vital to a healthy, functioning economy. In today’s analysis, Kristine Ziwica (@KZiwica), a journalist with 20 years experience working in Australia, the United States and the UK on human rights and gender equality campaigns, argues that we need to invest in our people and place care at the centre of the Australian economy.

This article by Stephen Duckett, Honorary Enterprise Professor in the School of Population and Global Health at the University of Melbourne, examines Australia’s 2022-23 Budget through a health lens and highlights missed opportunities for the federal government to improve primary care and aged care. It is republished from The Conversation.

New research shows households with young children are feeling the highest level of stress as a result of the COVID-19 pandemic. This is highest for families in communities that experience moderate levels of poverty. Professor Abigail Payne from the University of Melbourne discusses what needs to happen to ensure families are not left behind as we look ahead to the COVID-19 economic recovery.

According to a recent Anglicare Australia report, more than three quarters of Australians surveyed using a representative national sample method supported the creation of a permanent basic income. Last year’s JobSeeker/JobKeeper experience showed us the potential of this approach. This article from Nikki Stefanoff (@nikki_stefanoff) was originally posted on Pro Bono Australia.

One of the headline figures in Tuesday’s federal budget was a A$1.1 billion dollar investment in women’s safety. This came as part of a special women’s budget statement, which pitched the budget as helping provide women with “respect, dignity, choice, equality of opportunity and justice”. It also comes amid a national crisis in domestic violence. On average, one woman is killed every week in Australia by a male current or former partner. So does the budget deliver on its promise to prioritise women’s safety and equality at home and at work? Does it do enough?

This post by Simone Casey (@simonecasey) and David O’Halloran considers a cross-disciplinary perspective on the effectiveness of JobSeeker sanctions, applying power relations and psycho-social lenses. This post originally appeared on Austaxpolicy: Tax and Transfer Policy Blog, with original version available here.

The important message for the community in these challenging times is that people seeking to repair their credit reports or negotiate with their creditors do not need to pay expensive fees.

Jensen Sass and Kate Henne, from the School of Regulation and Global Governance at the ANU, argue that the pandemic has opened up space for reconfiguring the relationships between states and markets.

A new report from the Centre for Social Impact provides an overview of the impact of the pandemic on the financial wellbeing of Australians, and explains the key elements of the government response so far.

If you have ever needed money in a hurry it may have been tempting to apply for a small loan to tide you over until your next pay packet. During Covid-19 and with increasing financial precarity, ‘payday’ loans may be how people resource short-term solutions as many people look online for financial help. Research from Dr Vivien Chen at Monash Business School’s Department of Business Law and Taxation shows the rise of digital platforms has significantly increased consumer access to payday loans. The financial risk posed by Covid-19 presents a key opportunity for governments to develop policy and mechanisms to protect people in financial distress. This article originally appeared in Monash Impact.

In today’s post, Dr Ann Kayis-Kumar, Professor Fiona Martin, Dr Jack Noone and Professor Michael Walpole from the University of New South Wales explain that many sole traders in Australia are experiencing financial hardship in the current pandemic because they are behind on their tax paperwork. Those helped by the UNSW Tax Clinic who were behind on their quarterly Business Activity Statements were, on average, seven years behind. Their financial vulnerability has long-term and widespread implications. This article was originally published in The Conversation.

In today’s post, Dr Andrew Joyce, Dr Perri Campbell, and Aurora Elmes from the Centre for Social Impact Swinburne argue that a social enterprise focused Job Guarantee could be an important part of a suite of policies to address imbalance in the labour market in the wake of COVID-19.

In today’s post, Matt Cowgill and Brendan Coates from the Grattan Institute explain why Labour Force data released by the Australian Bureau of Statistics on 14 May 2020 doesn’t capture the full impact of COVID-19 on jobs. This post is republished from the Grattan blog.

Research by Evgenia Bourova, Professor Ian Ramsay and Professor Paul Ali at Melbourne Law School highlights the challenges that financial counsellors and other consumer advocates face in assisting women with debt problems resulting from economic abuse — an often ‘hidden’ form of family violence. The risk of this type of abuse escalating during and in the wake of the COVID-19 pandemic is high. This article was originally published on Broad Agenda.

In what is fast becoming a global trend, the conservative Coalition was not expected to win the election held in 2019. Understanding how they did is critical to ensuring robust democratic systems in Australia. In today’s blog, Kate Griffiths (@_KGriffiths), Tony Chen and Danielle Wood (@DanielleIWood), all of The Grattan Institute (@GrattanInst), provide an analysis of how the record $90 million spent by Clive Palmer’s United Australia Party swayed the outcome of the election and provide insight into much-needed donation reforms. This post first appeared on The Grattan Institute web site; you can read it in its original format here, or read more about the author’s analysis in their related piece in The Conversation.

With the government’s recent announcement that they plan to start rolling out the Cashless Debit Card beyond its trial phase, thousands of people currently struggling to get by on low rates of the Newstart Allowance are poised to have their lives made even harder. The Accountable Income Management Network (@AIMNau) today outlines some of the key concerns why expanded the CDC is a bad idea - for low-income Australians and for the Big 4 banks, Coles and Woolworths.

The newly announced inquiry into Australia’s retirement income system comes 25 years after the introduction of compulsory superannuation. In today’s blog post Richard Holden, Professor of Economics at UNSW, discusses fundamental problems with the current system, and that what is needed in Australia is a retirement income revolution.

This post originally appeared in The Conversation under a Creative Commons licence. Read the original article.

As part of her popular Green New Deal platform, the US member of Congress Alexandria Orcasio-Cortez has been utilising Modern Monetary Theory (MMT) to explain how governments can fund environmental policy reforms. But could MMT also be used by the social sector as a message frame to promote social policy reform? In today’s blog post Dr Andrew Joyce from the Centre for Social Impact and Celia Green from UNSW discuss the how the social sector could leverage insights from MMT to promote paradigm shifting social policy reforms.

Congestion charging is a feature in many cities around the world, but Australia has been reluctant to introduce such a policy, instead focusing on developing infrastructure. However new analysis from the Grattan Institute suggests that a congestion charge would be a better and fairer way of tackling congestion than spending more on infrastructure. Marion Terril and James Ha from the Grattan Institute discuss the implications below.

This article originally appeared in The Conversation under a Creative Commons licence. Read the original article

Australia’s system of social welfare is based on mutual obligation. But what happens when those obligations become so onerous that people simply stop seeking to claim government benefits? Professor David C. Ribar from The University of Melbourne dicusses this issue for those on Newsart.

This post originally appeared in The Conversation

In this BusinessThink re-post, Dr Ann Kayis-Kumar from the University of New South Wales Business School introduces us to the Nationwide Tax Clinic Program. These federally funded clinics are designed to meet the needs of Australia’s vulnerable taxpayers. Dr Kayis-Kumar explains why and how these clinics came about and concludes with the overarching purpose of the Tax Clinic program, to foster a more socially just tax system.

There has been increasing interest in revamping our economic systems to better support individual and collective health and wellbeing and distribute wealth more evenly, while doing more to protect the planet. In today’s post, recently-appointed VicHealth (@VicHealth) postdoctoral research fellow Melissa Kennedy of Deakin University (@DeakinSeed) explains what Community Wealth Building (CWB) is and how a recent Masterclass in the Victorian Goldfields region explored its transformative potential.