The bidirectional relationship between financial hardship and women’s mental health

The Royal Commission into Victoria’s Mental Health System provides an opportunity to consider the social and economic factors that contribute to poor mental health using a gender lens. This piece by Sarah Squire (@SquireSarah) and Policy Whisperer Susan Maury (@SusanMaury) of Good Shepherd Australia New Zealand (@GoodAdvocacy) explores how financial hardship and stress contribute to poor mental health, drawing on case studies and reflections from practitioners in Good Shepherd services. This is the third in a 4-part series based on Good Shepherd’s submission; Part 1 provides an overview of the gendered nature of mental health, while Part 2 discusses the related issue of economic inequality, and part 4 focuses on the impacts of violence, sexualisation and gender stereotyping.

As noted in our second blog in this series, economic security and mental health are strongly linked. The economic participation and wellbeing of women is one of Good Shepherd’s five impact areas. We respond to women and families experiencing financial stress on a daily basis though our financial counselling services. In undertaking this work we understand that, as Salignac et al (2019) frame it:

“Financial wellbeing is not just about an individual’s financial circumstances. A person’s household, community and social contexts as well as transitional or life-course events (e.g. moving out of home, having a baby, changes to employment status and income, and retirement) and financial shocks, can contribute to it in the present and future.”

We have observed first-hand the clear link between financial hardship and poor mental health. The effects of financial hardship are multifaceted and include physical, psychological and cognitive effects. Further, these links can be bidirectional, with poor mental health preceding or following (see also here and here) financial stress.

Women and financial hardship

When there’s not enough money to make ends meet: Women are more likely to experience financial hardship, which has direct and indirect impacts on mental health. Photo credit: Burst.

Relationship breakdown and reliance on low levels of income support and/or precarious forms of employment are common features of women’s experience of financial hardship. Nearly all of the women who participated in Good Shepherd’s Welfare to Work research reported having their income support payments cut. As a result, some women went without eating – sadly quite normal, it turns out – while others relied on food banks or family members to meet their essential costs. Only four out of the 26 women interviewed would be able to raise $2,000 in an emergency, through borrowing from family or selling assets. Many single parents of young children live in fear of the day when their youngest child turns eight and they will be moved onto the lower Newstart payment.

Many of our financial counselling clients have experienced economic abuse; see Portia’s story below. Economic abuse – a form of intimate partner violence – refers to behaviours that are intended to “control a woman’s ability to acquire, use and maintain economic resources”. It often presents with other forms of family violence and can continue long after the relationship has ended, thereby eroding victims’ financial security. One third of the women we interviewed for our Welfare to Work research reported current or previous experiences of family violence.

Stories from the frontline

The experience of financial counsellors is that financial difficulties, debt and vulnerability are an important mental health co-morbidity. There is an increasing demand for financial counselling as financial decision-making has become more challenging in an increasingly complex and diverse financial system. Rising living costs, unfair utility contracts, the expansion of the use of credit to pay for essential services, and credit products such as payday lending place vulnerable people under considerable stress.

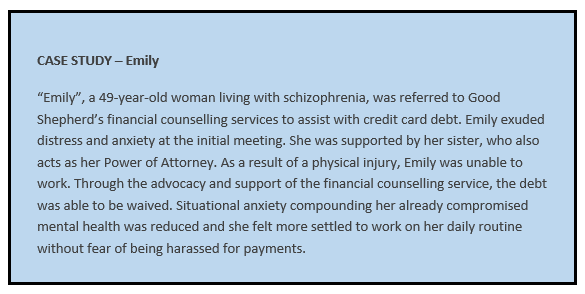

Our case work shows that practical assistance at the right time can significantly reduce the impact of financial hardship and stress as contributing factors to poor mental health, as in the case of “Emily”.

Alternatively, as Portia’s story shows, without alignment between the work of financial counsellors and the mental health service system, sustained positive outcomes may not be possible.

Mental health must be considered in an ecological context

The Financial and Consumer Rights Council Inc submission to the Royal Commission into Victoria’s Mental Health System notes the bidirectional relationship between financial hardship and poor mental health:

“A deterioration in a person’s financial position can cause situational distress and left unaddressed can be a major contributor in triggering a mental health crisis. At the same time, long term mental health conditions can contribute significantly to the likelihood of a person making poor financial decisions, or living in poverty, along with other co-morbidities such as harms from substance use or gambling.”

This relationship is best understood through an ecological perspective which sees an individual’s financial wellbeing in interaction with their environment - that is, a person's relationships as well as social and institutional structures – see Figure 1 below from Salignac et al.

The relationship between financial and psychological stress also needs to be understood in the context of events across the life course. Challenging life course events can have different consequences depending on when they occur in the life trajectory. Accumulated periods of financial stress from adolescence to mid-age predict poorer mental health later in life.

Women’s working lives take a different trajectory to men’s, often leading to lower levels of pay, reduced retirement savings, lower career status, and higher rates of precarious employment. They are also more likely to experience economic and other forms of abuse and experience household poverty as a result of reliance on income support payments and single parent status. While the Commonwealth and the Victorian Governments have prioritised addressing mental health, this cannot be done effectively without considering social and environmental factors. Women who experience compromised mental health will be best supported through integrated services that connect with financial counselling and family violence services.

If this post has raised issues for you please contact Beyond Blue on 1300 22 4636 or Lifeline on 13 11 14.

You can also find a free financial counsellor by visiting the National Debt Helpline website or calling them at 1800 007 007.

This post is part of the Women's Policy Action Tank initiative to analyse government policy using a gendered lens. View our other policy analysis pieces here.