Australia’s private hospital market – the dead cat bounce in 4 graphs

Australia’s health system is a complex web of health services provided by government, the private sector and the non-for-profit sector. As our understanding of deferred and unmet need evolves following the shocks to the Australian health system as a consequence of the COVID-19 pandemic, questions arise as to the contribution and sustainability of private health insurance. How might consumer behaviours change as we continue to head into dark economic waters? How will State and Commonwealth Governments respond? Can this dead cat continue to bounce? Stephen Gow with Open Advisory Services examines recent private health insurance trends and provokes critique of assumptions for the future.

Image source: Open Advisory Pty Ltd

As the stories from the pandemic keep evolving its interesting to revisit some of the pre-pandemic issues surrounding hospital care and the role of private health insurance (PHI) in Australia.

There has been much discussion regarding the continual decline of the PHI market with coverage rates decreasing from 2015. The decline in coverage impacts the financial viability of the sector and contributes to the annual increase in premiums – further decreasing the attractiveness of coverage.

Despite many policy changes across years, all it took was a global pandemic to turn this around.

Coverage rates have been increasing across all states and territories from June 2020, with the overall Australian rate of 45.2 per cent in June 2022 higher than at any period from March 2018. A truly remarkable turnaround. Refer Figure 1.

Its not clear what has driven this change in every State, but it is likely that multiple factors have driven consumers including the lowest premium increase since 2001, consumer perceptions of increased likelihood of needing hospital care (due to the pandemic), and a lack of certainty that the public hospital system will be able to meet their needs (due to it being under pressure from the pandemic).

Figure 1: Hospital Treatment Coverage (insured persons as % of population) by State and Territory

The growth in coverage has not been uniform across all ages with the big turn around occurring in the younger age groups (Figure 2). There are 253,000 additional persons insured aged less than 70 years in 2022 compared with 2020, in comparison to the loss of 213,000 insured persons in the two previous years.

Figure 2: Change in persons with Private Health Insurance - Hospital Treatment March 2018 to March 2020 and March 2020 to March 2022 (Australia)

Source: APRA. Private health insurance membership trends June 2022 (released 24 August 2022)

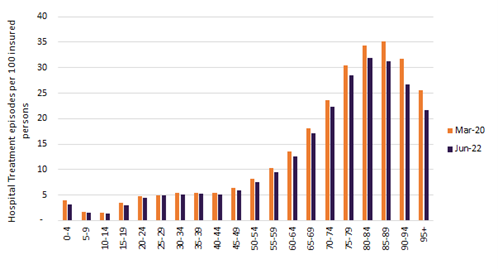

This is great news for insurers as it increases the premium base and reduces the overall risk of the insurance pool, as people aged less than 70 are four times less likely to claim compared to people aged 70 years or older (Figure 3).

Figure 3: Hospital treatment episodes in private hospitals per 100 insured persons by age group March 2020 and June 2022

Source: APRA. Private health insurance benefits trends June 2022 (released 24 August 2022)

So how has this flowed through to private hospital activity?

The news is not good, with mostly annual declines in overnight episodes from 2018 (Figure 4), and some growth in day only activity. These declines from the pre-COVID years of 2018 and 2019 were exacerbated by activity restrictions across some states in 2020 and 2021 aimed at ameliorating the impacts of the pandemic on the health care system.

Figure 4: Acute private hospital day only and overnight activity funded through private health insurance - episodes and % annual growth - Australia

Source: APRA. Private health insurance benefits trends June 2022 (released 24 August 2022)

So where to from here?

Hopes are high for a recovery of the sector. This could be achieved through additional demand generated to address the backlog of elective surgery that was not able to be undertaken in the public and private sectors over the past years. However, the fundamental issues of cost to the consumer remain with high and uncertain out of pocket costs a residual factor that has largely not been addressed by the sector. Addressing these structural issues in the sector is fundamental to achieving lasting change as the recent shifts to the coverage rates will not be enough to stimulate sustained growth of the sector.

Stephen Gow is the founder and Managing Director of Open Advisory Pty Ltd which a specialist health system planning advisory service based in Melbourne. Open Advisory works with clients to explore system planning, workforce, and design questions, drawing from professional insights derived from extensive work across Australia and internationally. Stephen Gow can be contacted at stephen@openadvisory.com.au and followed on twitter at @gow_stephen.

Moderator: Jade Hart